It wasn’t that long ago when the first contactless keycards made it into the mass market, or maybe it was and I’m trying not to feel old, but they brought one of the first major technological innovations that the public understood. There have been other major changes in internal bank systems, allowing faster cross-border transfers for example, but nothing that the average person would notice.

The first reaction from the public was the “WOW” effect.

YOU TELL ME THAT I CAN PAY WITHOUT EVEN TOUCHING THE TERMINAL?!? OMG – A real person being interviewed by our expert journalists

But the second reaction was more like Sidney running from Ghostface.

Please don’t sue us for memes

Wait if I can pay without touching the terminal, does that mean that someone can remotely steal my money?

Aaaand as with every innovation, the first round of applause and excitement, got replaced with fear. To be fair, there wasn’t that much of a reassurance from anyone that a hack on these cards can’t be performed, and still to this day you can get some credit card details using the NFC of your phone (Android only, sorry Apple fans). While you can’t do any damage, it does freak people out and some potential hacks have been demonstrated, but it neglects a lot of things for it to be performed.

Either way though, you may have your doubts but the technology works, and people are using it daily, but that was all the way back in the 00s, what’s happening now in the Fintech world? Well, you name it we’ve got it. From smart trading platforms to bot trading, Personal Finance Management solutions, Digital banks, mobile wallets, phone manufacturers offering credit cards, and mobile network providers becoming banks…..wait what?

As I said, you name it we’ve got it. Technology advancements and the evolution of the banking field, along with several law relaxations, have to lead to a fintech boom that resulted in numerous start-ups being created and new products being offered by banks. The Financial landscape is changing and it is showing, rather aggressively I’d say. Many people may not immediately notice it, since it depends on how engaged you are with technological developments, but new products are finding their way into the market.

For the sake of not asking you to spend 3 hours of your time reading my, arguably, less than excellent assortment of words, I’ll focus on 5 sectors of the Financial market that Fintech companies are driving change and growth. Don’t ask about the number I’ve seen others do it and I want to be with the cool kids.

1. Online Payments

The terms “online” and “payments” are fairly recent developments and with good reason. Online security hasn’t always been as strong as it is today, and payment providers had to both account for threats on their systems as well as their users’ systems. Protecting your infrastructure is slightly less difficult than protecting your software, which is running on unsecured computers, by inexperienced users using buggy browsers; I’m looking at you Internet Explorer, Edge, or however you call yourself these days. You may see a recently captured video of a Software engineer constructing such a system below:

Real footage and not from a movie

As demanding as it can be, the rise of e-commerce required the existence of systems able to handle payments through browsers. And one of the first such systems was of course our dear old pal…PayPal, see what I did there? Paypal was one of the first companies to offer money transfers and later on adding payments to their system, with eBay buying the company for an amount that would make a grown man cry. From then on we’ve had multiple companies providing such solutions like Square, BrainTree, Stripe, and Venmo to name a few, I assure you their sorting is completely random. Creating such systems requires huge investments in Security, Regulatory approvals, Customer Infrastructure, and Developer tooling, which are several of the reasons that it is not an everyday occurrence that such a start-up pops up.

2. Smart Online Trading

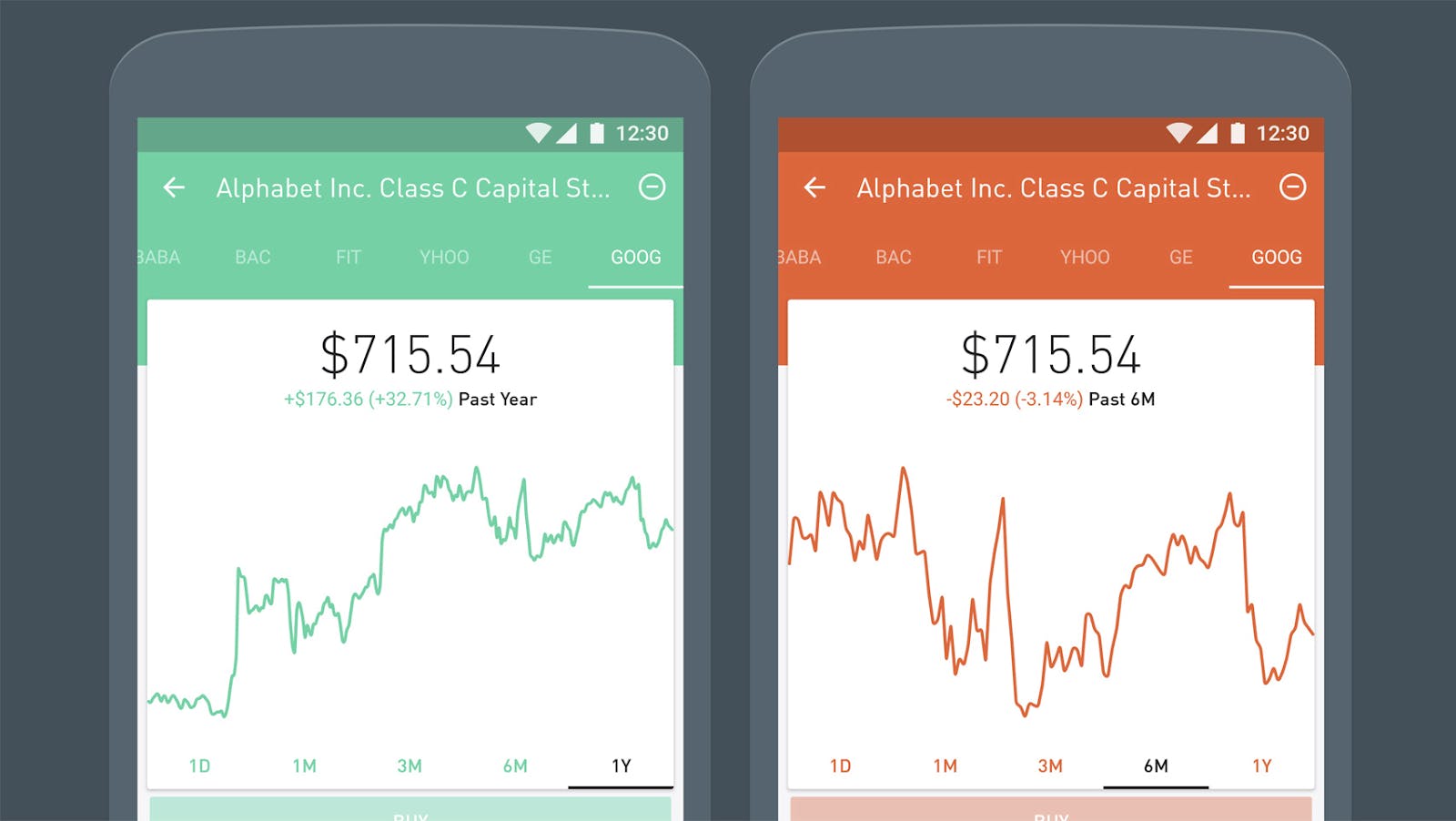

Remember the stock market? This is how it looks now, feel old yet?

To be fair, the stock market is still there, but the average person is more likely to invest their money through newer and smarter solutions like Acorns, RobinHood, and eToro. And that’s not all, of course, there are now even more ways to invest, for example, platforms like mintos allows you to invest in loans in P2P lending schemes. Does it work? Well, some say it doesn’t some other swear that it does, but I’d be lying if I said that I’ve tried it and I am now a millionaire.

Trading has changed, not so much for the actual traders, but as far as accessibility from the average Joe is concerned. You can now download an app that saves your change from each transaction and invests it in your very own personal portfolio of stocks. It has allowed people to save more money, earn some extra, and the actual traders to have more money flowing into the stocks, driving the market up. Mostly, everybody wins, though that is not always the case. Remember that you always risk your capital when you invest in anything.

3. Mobile Wallets/Payments

If you tell me that when smartphone manufacturers announced that you can pay from your phone, you weren’t excited I simply would not believe you. It is something that I still smile about until today, and I’m pretty sure that in the next 10 years people are going to see it as the obvious thing to do. Whether you have an Android smartphone with (Google Pay, Samsung pay, etc) or Apple’s iPhone with (Apple Pay), you get the ability to pay with your trusty companion that is always with you. I swear if they added digital IDs, I’d leave my wallet at home. While this statement may make some of you anxious, thinking of a dystopian future where all your life exists into small chips, I think that we have something really to gain here.

Paying with your smartphone or smartwatch is an awesome convenience that allows you to carry only your id with you and simply pay with them, freeing up your pockets and not worrying about losing a credit card. And obviously, you might say “but what if my phone gets stolen”, yeah that would be a concern but phones and watches that support these features are pretty much bulletproof when it concerns giving up your card’s information and can be remotely wiped and locked in less than 20 seconds, provided you are near another device you can use of course. For example Apple devices store card information in a secure element; so cryptographically secure that not even the company could access it if they wanted to, and what’s more they replace your card’s details with new ones. This means that card terminals authorize an apple card that is connected to yours and not your own directly. All and all, it safer to lose your phone than your wallet nowadays, at least as far as iPhones are concerned.

There is also another form of mobile payment one that is not providing convenience, but one that is powering growth and advancement. Mobile providers have partnered with payment services providers, to allow people, in multiple African nations under development, to pay using SMS messages on their phones. This is perhaps the most groundbreaking advancement, since it allows people with no traditional banking systems, to add their money into bank accounts that they can use without debit or credit cards and without smartphones. This has allowed them to save up without capital getting stolen, either theirs or the businesses they pay to, facilitating a financial boom.

4. The *insert name here* Bank

Many Apple fans were astonished when apple announced their credit card, which is provided by the company and connected to their smartphone. It was the first time that a private company offered a credit card and not simply a wallet, and while many thought of its style, convenience, or simple prestige that it might give you, for me, it was something else. It was the beginning of a new type of bank, one that is closer to you, since it is on your phone, and with the rise of e-sims and new communication technologies, it is easy to imagine a future where your phone is not simply a phone. You buy from a manufacturer and you instantly have their bank, their credit card, their mobile network and wherever you go they follow you, cross-borders, cross-state everywhere. I’m sure that most wouldn’t give it much thought, since you already carry your phone everywhere, what would be the issue if it also contained the rest of your life that wasn’t yet tied to it.

Apple isn’t though the only one doing something like this, as we saw in the previous section, mobile network providers are also joining the fray, and coupled with new regulations in the EU, where you can create a digital bank far more easily than you ever could create a physical one, it begs the question that can anyone be a bank nowadays? It certainly seems so, but it’s not that new of a concept, it’s simply easier now. Do you know that Volkswagen has its own bank, actually many of the giant corporations have their own banks, simply because they have the capital required and it allows them to invest it and profit from it, instead of just having cash piling up. Well, I’d like to have that problem one day, but you get my point.

5. The Online Store

Chances are that you’re doing a lot of online shopping. Yeah yeah I know, I should cut back too, but if current trends hold or increase, the physical store will eventually die, not completely, but as we know it. Businesses get more profit by simply having an online presence that has server costs, compared to a physical store that requires rent, electrical bills, water bills, property taxes, phone/internet bills, cleaning and you get the idea. Customers, on the other hand, lose the ability to touch and try the products that they want to buy, but at the same time have the convenience to go on a shopping spree in their pyjamas, from a scientific station in Alaska.

E-commerce is on the rise, and during the Covid-19 era even more so. It seems that we are increasingly using online stores for shopping and that isn’t going to stop anytime soon. The Fintech community has caught up to it too, you have platforms like WooCommerce, Presta Shop, Shopify, Magento, Open Cart, and more. Some of these platforms are more than 10 years old and have millions of shops, while solutions like Shopify not only provide you with an online store presence but they also deal with a lot of the hassle that there is in running one.

Online shopping enablers are catching up too, Banks are creating online payment APIs, you already have the providers we mentioned earlier, mailing companies are opening their APIs to automate product pickup and delivery, ERP and stock software are integrating directly with online shop solutions and generally the entire lifecycle of an online order is getting better-automated support. And this is extremely important, since not only does it allow a store to operate faster, it also cuts down costs since everything is getting automated and it allows you to serve more customers than ever before.

Pheeeew that was something

Yeah, I told you it would be long, don’t judge me. To conclude my Ted talk, our world is changing like always, but now it’s faster than ever before and one of the most important sectors of it, the Financial sector is undergoing an unprecedented revolution. I didn’t even touch the subject of cryptocurrencies and we still saw multiple innovations that are happening. Since I mentioned that, why don’t you go ahead and send me an e-mail at contact@quintessential.gr if you want to see what’s that all about?

Here at Quintessential, we don’t only write about Fintech, we also create Fintech products, go ahead and take a look at Pulse, a platform we created for Cardlink, or maybe subscribe to our newsletter so that we can tell you about a new app we’ve been working on? *Spoiler Alert* It’s awesome.